It is uncommon to find an adult without at least one credit card today in Canada or most advanced countries all over the world. Credit cards have come far and stood the taste of time; hence, the mass adoption. When utilized correctly, credit cards are an exceptional tool for building a healthy financial future.

Even with all its perks, some people still find it unbelievable that a credit card expires. Does it seem odd that credit cards have expiry dates? Well, it shouldn’t; the credit card expiration date allows card issuers to send an updated card upon renewal. This also helps to keep your account safe and secured, not forgetting aking your card usable.

Let’s take a look at how to check your credit card expiry date in Canada and what happens when your credit card expires in Canada.

Credit Card Expiration Date

A credit card expiration is a figure that tells you the exact date your card will no longer be valid. After that date, you won’t be able to use your credit card because the card issuer would have deactivated the credit card upon expiration.

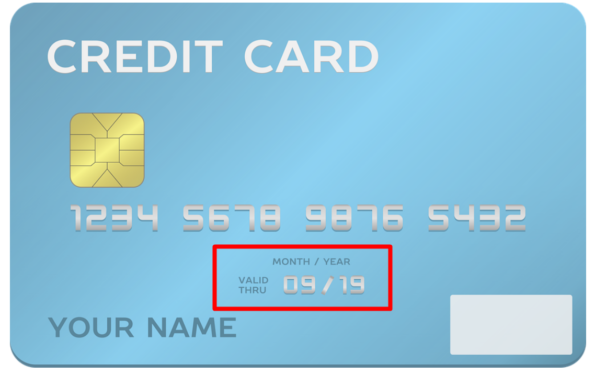

Generally, a card expiration date is a two-number format featuring both month and year. The first number is the month, while the second number is the year. A card expires on the last day of the month; this is after a few years after issuance.

How to Check Your Credit Card Expiry Date in Canada

Your credit card expiration dates are usually displayed on the front of the card. Check the lower right-hand side under the account number; you’ll find the expiration date there.

The expiration year’s duration depends on your card issuer; usually, it spans between 2 years and above. An example of a credit card expiration date is 12/2099; this means that the card will expire on the last day of December 2099.

Most credit card issuers send out messages and a new credit card in the 30 to 60 days before your card expires. At the same time, others will send you a letter or an email requesting if you’ll like a renewal.

Note that the expiration dates on credit cards do not refer to your account expiration; instead, it is your card. These dates aim to secure your card from fraud and replacing it from wear and tear from constant use. When your card expires and an update on cards from your issuer, be sure to get a new card with updated designs, features, etc.

Why Credit Cards Expire

There are currently several reasons why credit cards expire; some of them include:

- Wear and tear

With time, the card’s chip can become worn out while the plastic can break due to constant use. An expiry date helps you replace the card; usually, your credit card issuer will send you a new one every three years; this depends on their regulations.

- Fraud Prevention

Regardless of the platform, you are using your card, whether in person, online or over the phone, the expiration date gives you added data that can be reviewed to ensure the card details is valid. It also proves that you are a legitimate user.

- Offers and Promotions

When your credit card expires, your card issuer has the chance to advertise new products to you. You can choose to stay with the offers on your old credit card or upgrade to a more recent product with enticing features. You’ll indeed be hit with several options.

It is advisable always to compare and contrast the various credit card options provided against your old one. You can do this by researching the credit cards your issuer is offering; this will aid you in your selections, make you fully prepared, and know what to expect when you receive your billing.

- Re-evaluation

Credit cards expiration dates provide card issuers access to re-evaluate your credit card terms depending on your current creditworthiness. It also helps issuer enhance their marketing chances by sending you updated credit cards.

What to do when your Credit Card Expires

Your card expiring might be a good way for you to evaluate all the ways you utilize your card. You can go over your credit card statement and review your recurring charges.

If you’re sure you still want to utilize an automatically charged service to your credit card, you’ll need to update every merchant’s payment details. It might also be the right time to cancel any services you’re not using.

When replacing your old card, ensure you destroy your old credit card to protect against fraud. If not appropriately discarded, anyone can pick it up and use it to commit financial fraud. It is advisable to shred or cut up the card. Alternatively, to be on the safer side, you can bag the credit card pieces in separate trash bags.

Receiving Your New Credit Card

Even before your card expires, your card issuer is already working underground to provide you with a replacement card. Usually, your credit card issuer will mail you a new credit card a few weeks before your old card expires. Note that you’ll need to activate the new card before using it.

You can activate your new credit card by calling your issuer’s toll-free number on login to their website to commence using your new card. Once you’ve activated your new credit card, you should discard your old card properly. Remember to sign the back of your new card; there’s a space for it on your card.

Before activating your new credit card, confirm that the old card’s terms and conditions match the new card. Confirm that the Annual Percentage Rate (APR), that is, the interest rate you pay, is still the same.

Also, ensure that the payment due dates, fees, and penalties are unchanged before renewing your credit card. It is better to check and get all facts correct rather than discovering after renewal.

Note that your new credit card will come with the same account number; however, the CVC2 will be different. If you have any recurring payment on your credit card, such as a utility bill, it is crucial to inform your new expiry date’s service providers.

It is advisable to note your credit card expiry date so you’re not caught unaware in a situation where you have to find out your card has expired.

In a case where your credit card is close to expiring, and you have not gotten any message from your issuer or received your new card in the mail, you should call your issuer. If you recently changed your address, you’ll have to inform your credit card issuer before your card expires so they’ll have your new mailing address.

Conclusion

As a credit cardholder, it is crucial to keep in mind your credit card’s expiry date. As mentioned above, your card expiry date is not the same as your account expiry date. Also, credit card expiry date serve different purposes, among which is fraud prevention.

You can always request a replacement credit card from your issuer if the digits on the front of the card are worn and barely readable. Don’t forget to give your issuer a call if your credit card is about to expire and you have not received a new card in your mail or a message to that effect.