Have you been asked to provide a void cheque and don’t know what it means? When you set up automatic payments for a direct deposit or a utility company, or other recurring bill payments involving your checking account, you may be asked to provide a voided cheque alongside your paperwork.

Learning how to void a cheque properly is essential to ensure you give the right information and secure your bank account details. Fortunately, it is a simple process to void a cheque in Canada. But before you learn how to void a cheque, you need to know what it is and how it works.

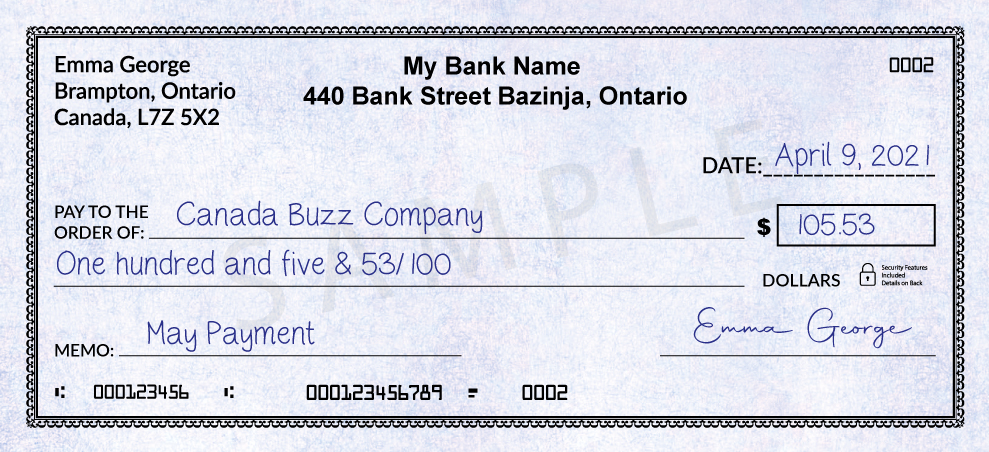

Cheque Example

This is an example of what a typical cheque looks like in Canada. The sample cheque below would still be valid if it were a real cheque. A void cheque, however, is different.

What is a Void Cheque?

A void cheque is like any other cheque but with the word “VOID” inscribed across the entire cheque. The implication is the cheque will not be accepted for payment.

However, the cheque is still useful because it contains information that can be used to process electronic payments. Another reason why the word “VOID” is inscribed is to prevent it from being used as a blank cheque.

How Does a Void Cheque Work?

A void cheque’s primary function is to retrieve information that can be used to create an electronic link and verify your account.

At the bottom of the cheque is a set of numbers that include your bank’s routing numbers alongside your account number, which helps to ascertain information needed to withdraw or deposit funds. Some instances where you need to void a cheque include:

Setting up direct deposits

You’ll need a copy of a voided cheque if you receive electronic payments from your employer. Although your employer might ask for your bank routing number and bank account number on a form, your employer’s HR department will likely require a voided cheque copy as well.

This information enables the money to move into the right place. Other payment services may also need a voided cheque copy when setting up an account.

Automated loan payments

Void cheques are often needed to set up automatic loan payments like student loans, auto loans, personal loans, or mortgages. Depending on your settings, the bank will deduct the funds from your account monthly, bi-weekly, or weekly.

Automatic loan payments often have better rates, making it worth your while to send a voided cheque copy. You may also use a voided cheque to set up automatic electronic payments if you’re tired of writing cheques for expenses like insurance and rent.

Authorize a government agency to direct-deposit your benefits

You can set up direct deposits to receive your benefits electronically into your bank account like a direct deposit paycheck.

Errors

No one is above making a mistake, and if this mistake occurs while you’re writing a cheque, the best solution is to void it and start over. Be mindful that voiding a cheque is only possible before giving it to the recipient. If the cheque has changed hands, you’ll need to contact your bank immediately.

How to Void a Cheque Properly

Voiding a cheque is simple: Take out your checkbook and tear out a cheque, writing “VOID” across the entire cheque. Use well-spaced letters that are large enough to cover the cheque’s entire face but still ensure the bottom’s banking information is legible.

The excellent idea is to use permanent ink to make it nigh on impossible for thieves to erase the “VOID” letters on the cheque. It isn’t necessary to sign the cheque or fill in any other information.

Another option is to scan it and take a photo of the cheque if you require a void cheque in the future. If you do not have a void cheque, you can try the following options:

- Request a counter cheque, which the bank can print for you on demand. Be mindful the bank charges a small fee for this service.

- Inquire if you can use a preprinted deposit slip for a savings or checking account.

- Ask if a letter from your bank will suffice.

Once you provide a voided cheque, the information is collected and entered into the system. The cheque is then shredded to prevent anyone from retrieving your financial details. Be aware that you can void an already filled cheque, which serves the same purpose. A voided cheque copy, whether blank or filled, is preferable to the original in many cases.

Essential Considerations when Voiding a Cheque

- Keep a record of your voided cheque in a logbook or cheque register. Ensure you put a note that the cheque is voided for future reference.

- Consider sending an encrypted image of your voided cheque if you are sending it online. If you want to set up online payments using a voided cheque, someone can intercept the information before it gets to its destination. Where possible, send the voided cheque image as an encrypted PDF. Contact the recipient to make sure they accept encrypted files.

How to Void an already sent Cheque

Although quite expensive, it is possible to void a cheque after sending it. If you don’t want the payment to go through or there’s a mistake on the cheque you can request a stop payment request. This service costs up to C$35 and is not one you should consider using often.

FAQs

Can you cash a voided cheque?

It is debatable, but many a teller won’t cash a cheque with VOID written across it. However, there are instances when a voided cheque has been cashed. Before sending a voided cheque, ensure you don’t sign on it and only send an image of the cheque or a photocopy.

Is a void cheque the same as a direct deposit form?

No, although it is not uncommon for both to contain similar information. The purpose of a voided cheque is to verify your routing number and bank account number.

Can I use a voided cheque more than once?

Yes. Companies that require a voided cheque need the cheque to confirm your bank’s routing number as well as your bank account number. The information is on all cheque, meaning there isn’t a need to void another cheque if you need to send the same information to multiple companies.

Do I have to sign a voided cheque?

It is not necessary to sign a voided cheque, and best practices require you don’t. A voided cheque is simply a means of confirming your banking information like your name, routing number, and account number.