Cheques are a staple for banking transactions, and even though they aren’t as relevant as before, you still need to understand how they work. It doesn’t matter whether you’re setting up automatic payments or making a deposit; it is necessary to know how to read a cheque – especially if you can write one.

Cheques are basically divided into segments, which we’ll discuss below.

- Personal Information

- Payee Line

- The dollar box

- The Cheque Amount

- Memo Line

- Date line

- Signature line

- Bank Logo and Information

- Institution/Transit Number (aka ABA Routing Number)

- Chequing Account Number

- Cheque Number

- Bank Fractional Number

- The Back of a Cheque

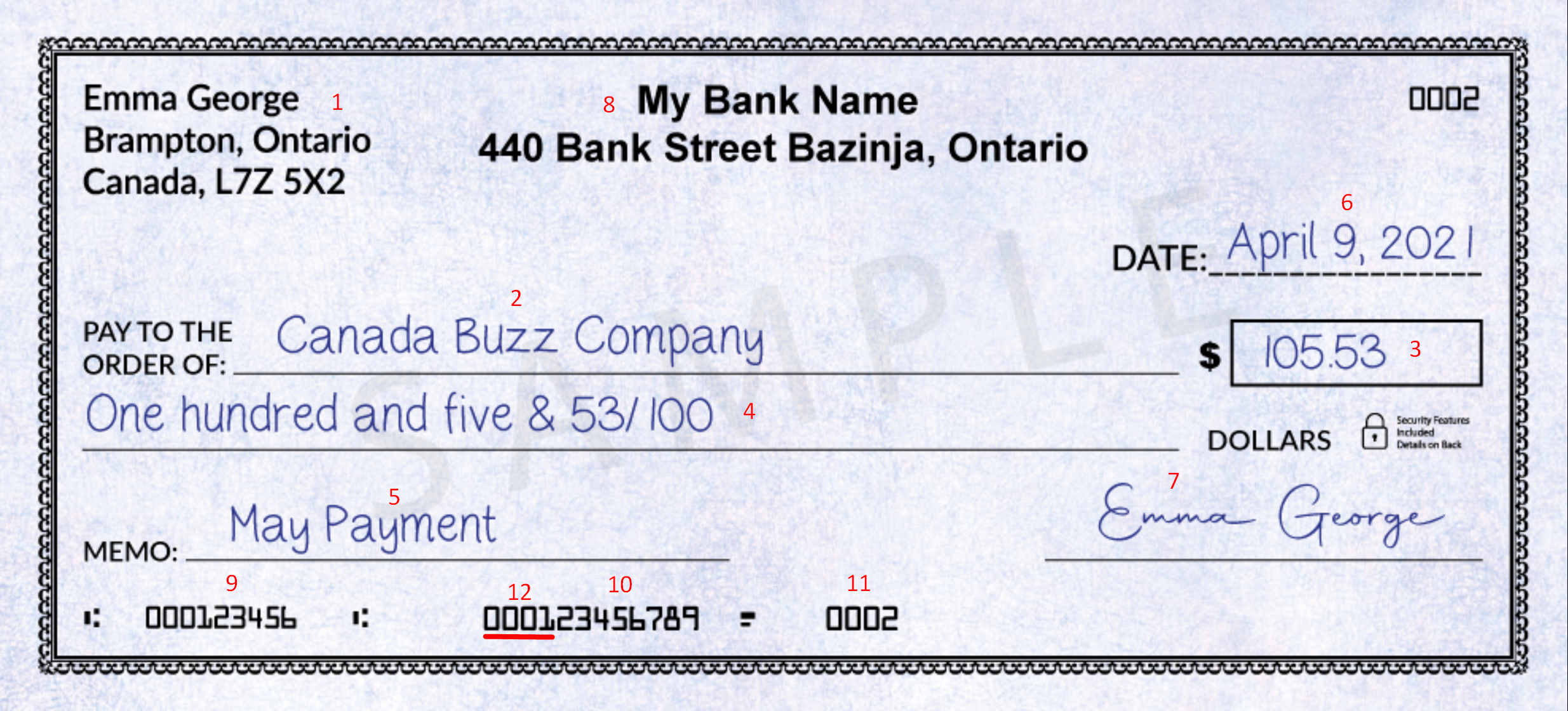

1. Personal Information

The personal information allows you to see the checking account owner’s details – or business account if your employer issued the cheque. The information is there just in case you want to contact the cheque writer.

Phone numbers may also appear there, but this isn’t true for all cheques. Other information you might find includes handwritten personal information like a driver’s license number or a phone number. This extra information may sometimes be required before the teller accepts the cheque.

2. Payee Line

The payee line’s purpose is to see the cheque’s recipient or who the cheque is written to. This segment often includes a business’s specific name or a person permitted to cash or deposit the cheque. The cheque can be payable to cash in some instances, enabling almost anyone to cash or deposit the cheque.

3. The dollar box

This box contains the optional information of the cheque amount. It is written in numerals and includes the figure of the cheque. The dollar box is convenient to guilty get a glimpse of how much the cheque is for. The dollar box often cedes when there is a conflict between the amount in words and numerals.

4. The Cheque Amount

This amount is the legal amount of the cheque. The amount must be written in words and the correct amount intended by the cheque writer. In other words, it is what you’re officially entitled to as the recipient.

Nonetheless, you’ll only cash or deposit the funds if the cheque writer has adequate funds to cover the cheque. Be mindful that people do print out fake cheques, and it could take some time for your bank to know you’ve been defrauded. Do not spend the money unless you’re sure it’s there and have confirmation from your bank as an extra precaution.

5. Memo Line

The purpose of the memo line is to capture additional information the cheque writer might include. People often use the memo line to explain the cheque’s purpose or add a piece of reference information like a bank account number.

6. Date line

The dateline states the day the cheque is written – and in many instances, that’s what you see. But it is possible for people to “post-date” a cheque by writing a future date. The cheque’s date doesn’t necessarily signify when the recipient may deposit or cash the cheque or if the bank will accept it.

However, post-dated cheques are often so because of a reason, and it is excellent advice to ask the writer why the cheque is “post-dated.” Maybe the cheque writer doesn’t have adequate funds now, but the money will be available in the future. At other times, the cheque writer may be paying for a service ahead of time before the service is complete or payment is due.

7. Signature line

The signature line signifies the cheque signer. If the cheque in your possession has no signature, consult the cheque writer, or you’d have difficulties cashing or depositing the cheque. Your bank may also charge extra fees if the cheque isn’t accepted as valid.

However, there are instances (like reviewing your account transactions) where a cheque doesn’t have a signature with a message stating “No Signature Required.” Those are likely transactions you approved over the phone or online. Nonetheless, you should immediately contact your bank if you don’t recognize a transaction.

8. Bank Logo and Information

The bank logo or information tells you where the cheque writer operates an account, be it a credit union or a bank, and where the money will be deducted from.

If you prefer to cash the cheque in full, you may need to visit the physical bank branch to do so. You may also cash or deposit the cheque at your bank, but your bank might pay only a part of the cheque and hold the remainder.

9. Institution/Transit Number (aka ABA Routing Number)

The institution/transit number is designed to be read by a computer, and it helps to find the cheque writer’s bank. However, it is of no importance to know another person’s transit number.

10. Chequing Account Number

This number is the account number where the money will be deducted from. It is useful in situations where you’re setting up electronic payments out of your bank account.

However, it isn’t something you’re required to know when you’re receiving a cheque. The cheque writer’s bank and your bank will use the routing number and account number to process the payments.

11. Cheque Number

The cheque number recognizes the cheque in your hand. There are instances where the ABA number and account number are the same in a chequebook. To avoid confusion, a cheque number is also included in a cheque to make things more transparent.

If you receive more than one payment from the same cheque writer, it’d be an excellent idea to write down the cheque number for your records. In the same vein, it is also a great idea to note down the details of every cheque you write in a logbook or cheque register.

12. Bank Fractional Number

The bank fractional number is an alternative address used in processing payments. Memorizing this number has no useful purpose.

13. The Back of a Cheque

The recipient who cashes or deposits a cheque endorses at the back. The bank processes the cheque and stamp information containing a record of where and when the cheque was handled.

FAQs

What do the numbers mean on a cheque?

The different numbers on a cheque carry different information that is used to process the cheque. The numbers include cheque number, routing number, and account number. The route number is also known as the financial institution number or bank number.

What are the three types of cheques?

The three types of cheques are payroll cheques, cashier’s cheques, and certified cheques.

Can I go to the bank and get a cheque?

You can go to the bank and get a counter cheque that the personal banker or teller will print out. Note that these cheques may attract a small fee.