The T2033, also known as Direct Transfer, is a form used by Canadians to record the transfer of money between their registered savings plan or retirement plans. Generally, Canadians can transfer money between registered plans or from their retirement and savings accounts.

The Canada Revenue Agency (CRA) and any financial institutions involved require you to make a formal report when you make any transfer and when you need to claim funds. This is where the T2033 form comes in. The form comes in handy when you want to transfer money between several registered pans.

It is not the only form available for similar purposes but has its peculiarities. In this article, you will find an overview of the T2033 form.

What is a T2033 form? Uses

The T2033 is a form for Canadians to record direct transfers between their various savings plans or retirement savings plans. It also covers transfers made due to a breakdown in a marriage or a common-law relationship and non-resident.

It keeps records of the transfer for the CRA and the financial institutions involved. Different situations may warrant a direct transfer, hence, the need to use the T2033. Some of the situations may include;

Direct Transfer Payments of:

- Partial or Full Amounts from an RRSP (Registered Retirement Savings Plan)

- Amounts from a yet-to-mature RRSP

- Charges from an SPP (Specified Pension Plan)

- Amounts from a PRPP (Pooled Registered Pension Plan)

- Excess amounts from an RRIF (Registered Retirement Income Fund)

- Transfers Due to Divorce or Breakdown of a Common-Law Partnership

If your marriage or common-law partnership dissolves, there is a high possibility that property transfer, including money and lump sum payments from you to your former spouse or common-law partner’s account, will occur. Transfers included in this category are:

- Lump-sum payments from RPP (Registered Pension Plan)

- Amounts from an unmatured RRSP

- Amounts from an RRIF

- Amounts from an SPP

- Transferred Payment for a Non-Resident of Canada

Non-residents of Canada can use the T2033 to transfer money to and from registered savings accounts. This can attract extra charges if the money is transferred from another country or to another country. Such transfers include:

- An eligible portion of a retiring allowance

- Lump sums from RRIF and DPSP (Deferred Profit-sharing Plan)

- Full or partial amounts from RRSP annuity or refund of premiums paid to the beneficiary upon the annuitant’s death

- Payments from an unmatured RRSP

- Payments from an SPP or PRPP

You should not use the form for any of the following:

- A direct transfer of a full or partial commutation of an RRSP annuity to another RRSP or an RRIF

- A direct transfer of an excess amount from an RRIF to an RRSP; or

- A direct transfer from an RRSP or RRIF due to the breakdown of a marriage or common-law relationship

Instead, for the first two situations, use a form T2030 (Direct Transfer under Subparagraph 60(1)(v) and for the last one, use form T2220 (Transfer From an RRSP/RRIF to Another RRSP/RRIF on Breakdown of Marriage or Common-Law Partnership).

How To Get The T2033 Form

You can print the T2033 form yourself as the CRA doesn’t provide printed forms. You can also create your transfer form or adapt the form as it suits you and your client’s needs (for representatives) or conduct the transfers electronically.

Your financial institution may also have a form you can use in place of the T2033. This is because the T2033 is just a form for recording the transfer, and it can be recorded in the methods mentioned above, so the T2033 is not necessary for all situations. It is required that the transfer information is in an accessible and readable format in whatever way you choose.

How to Complete the T2033 Form

Before you fill the form, you should check the CRA’s website to see if the transfer you want to make is allowed. The transferor (the person from whose account fund or property is transferred) is responsible for ensuring that the needs of the transferee (the issuer of the transferred funds of property) and the annuitant (the person entitled to receive payments from the transfer) are met.

As the transferor, you must provide the transferee with the following details;

- The name, social insurance number (SIN), address, and telephone number of the annuitant

- The origin of the transferred funds (individual RRSP or RRIF number, and name);

- The description of the amount to be transferred (property, lump sum, or payments in cash or kind);

- The description of the savings plan (RRSP, RRIF, or RPP)

- The funds are to be transferred to

If the account is an RRSP or RRIF, you will provide the plan or fund name and number. For an RPP, you will provide the Canada Customs and Revenue Agency registration number and name. Also, you are required to provide the name and address of the RRSP issuer, RRIF carrier, or RPP administrator;

- A mark that the transfer is from a qualifying RRIF (if it applies);

- A mark that the transfer is from your spouse or common-law partner RRSP or RRIF (if it applies ); and

- An indication that the transfer is from a locked-in plan (if it applies)

You are also required to pay the annuitant the minimum amount of the year if you are making direct transfers under subsection 146.3. Generally, you are not to withhold income tax from the amount you transfer. Also, the amount transferred to the annuitant doesn’t qualify as their income and cannot be deducted. Therefore, the transferee does not ahead to issue an official receipt.

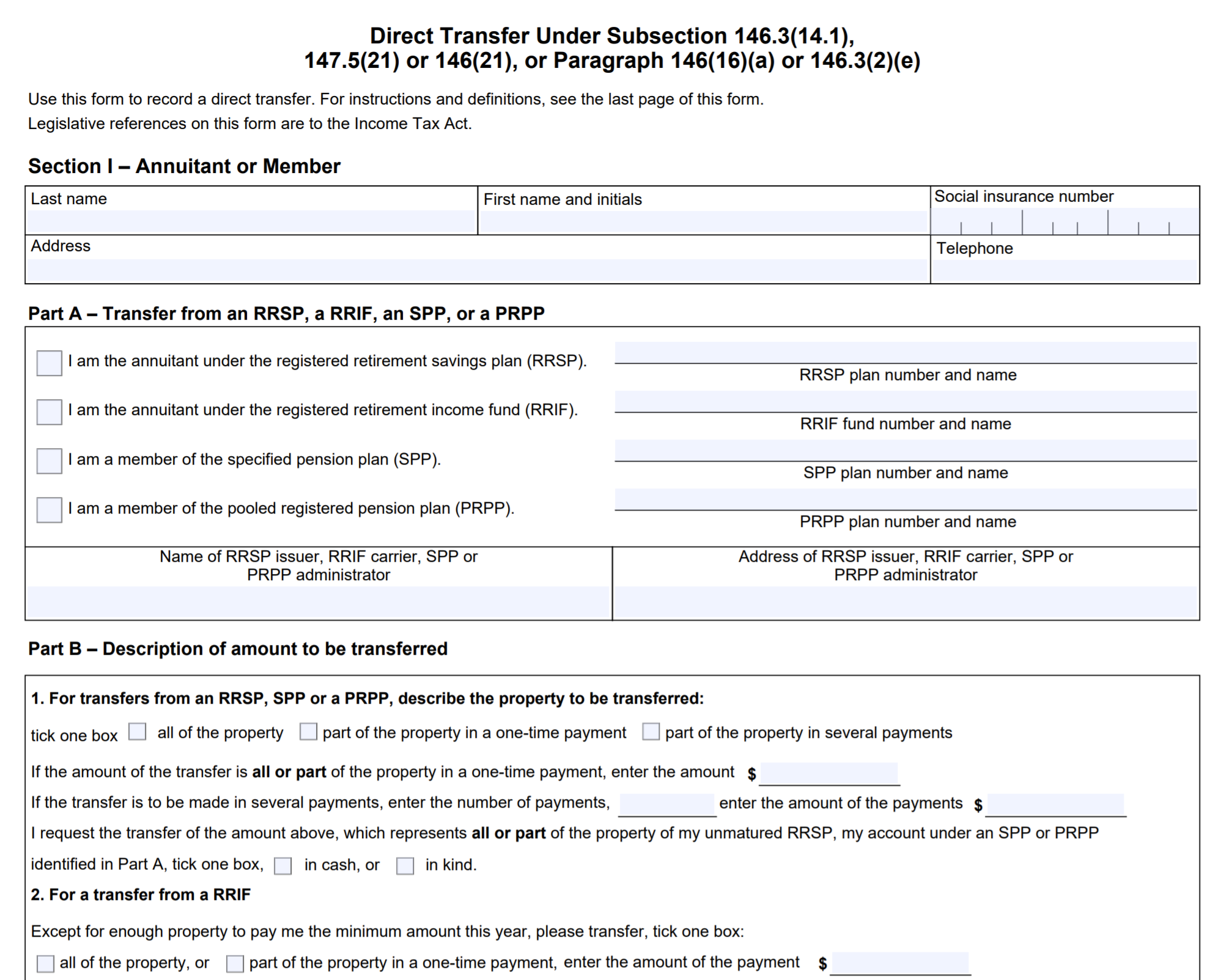

The T20333 has four sections that are completed by all the parties involved in the direct transfer. They are;

- Section 1

This part is completed and signed by the annuitant. Afterward, four copies of this area will be given to the RRSP issuer, RRIF carrier, or RPP administrator (transferee).

If the annuitant cannot complete this part due to specific reasons, the transferee can do so, and in place of the signature needed, a signed letter from the annuitant can be used.

This section has 3 parts:

Part A – Transfer from an RRSP, an RRIF, an SPP, or a PRPP

Part B – Description of the amount to be transferred

Part C – Identifying the RRSP, RRIF, RPP, SPP, PRPP or annuity to which the funds are being transferred

- Section II

This section of the T2033 is completed and signed by the transferee. The transferee will then send all the copies of this section to the transferor.

- Section III

This part is completed and signed by the transferor. They will keep a copy of this area and send the remaining three copies and the transferred property to the transferee.

- Section IV

This is also to be completed and signed by the transferee. One copy will be returned to the transferor, one will be given to the transferee, and the transferee keeps the last one.

If you meet all of the following criteria, you may need to include an additional form, the T2205, if you are transferring money to and from your account and that of your spouse or common-law partner;

If you or your spouse or common-law-partner contributed to your RRSP the year of the transfer, or in 2 years before the year of transfer

If you are transferring the amount to buy an annuity that can be paid in installments in three years or earlier

If either part 7. A) or 7. B) of the form is ticked yes. This indicates that either your spouse or partner contributed to your RRSP in any previous year, or it is an RRIF that includes amounts transferred from an RRSP to which your spouse or partner made contributions.

T2030 vs T2033

The T2030 form is different from form T2033 because it records only direct transfers that need to be taxed. When you transfer money using form T2030, the tax will not be withheld from the transfer, but when you use the T2033, the tax will be withheld from the transfer.

Conclusion

The T2033 is used to record direct transfers under subsection 146.3 of the Income Tax Act between registered savings plans. Transfers made under this form will not be deducted, and taxes are withheld from them.