The T1 General Tax Form or T1, also known as the Income Tax and Benefit Return, is an eight-page form used in Canada by taxpayers to file their income tax returns. It can be likened to a summary of all other tax forms.

It features your total income, your net income, your tax payable, your deductions, your non-refundable credits, and more as displayed on supporting forms and schedules and calculates the taxpayer’s refund or balance due.

What is a T1 General Tax Form Used For?

When you file your taxes, the T1 is used to apply for benefits like the Canada Child Benefit or refundable credits, such as the GST/HST tax credits and other benefits and credits. The Canada Child Benefit and the GST/HST tax credits can only be paid if a T1 is filed.

A T1 form can come in handy for employed individuals as it will aid them in proving their tax situation and income. Also, you might need it when applying for a mortgage or other major credit purchases.

Sections in a T1 Form

Canadians use the T1 General Form (Income Tax and Benefit Return) to file their income taxes. The form is practically a summary of all the other forms you complete for your income taxes and consists of your provincial or territorial tax with the exclusion of Quebec.

The T1 has five sections. They include;

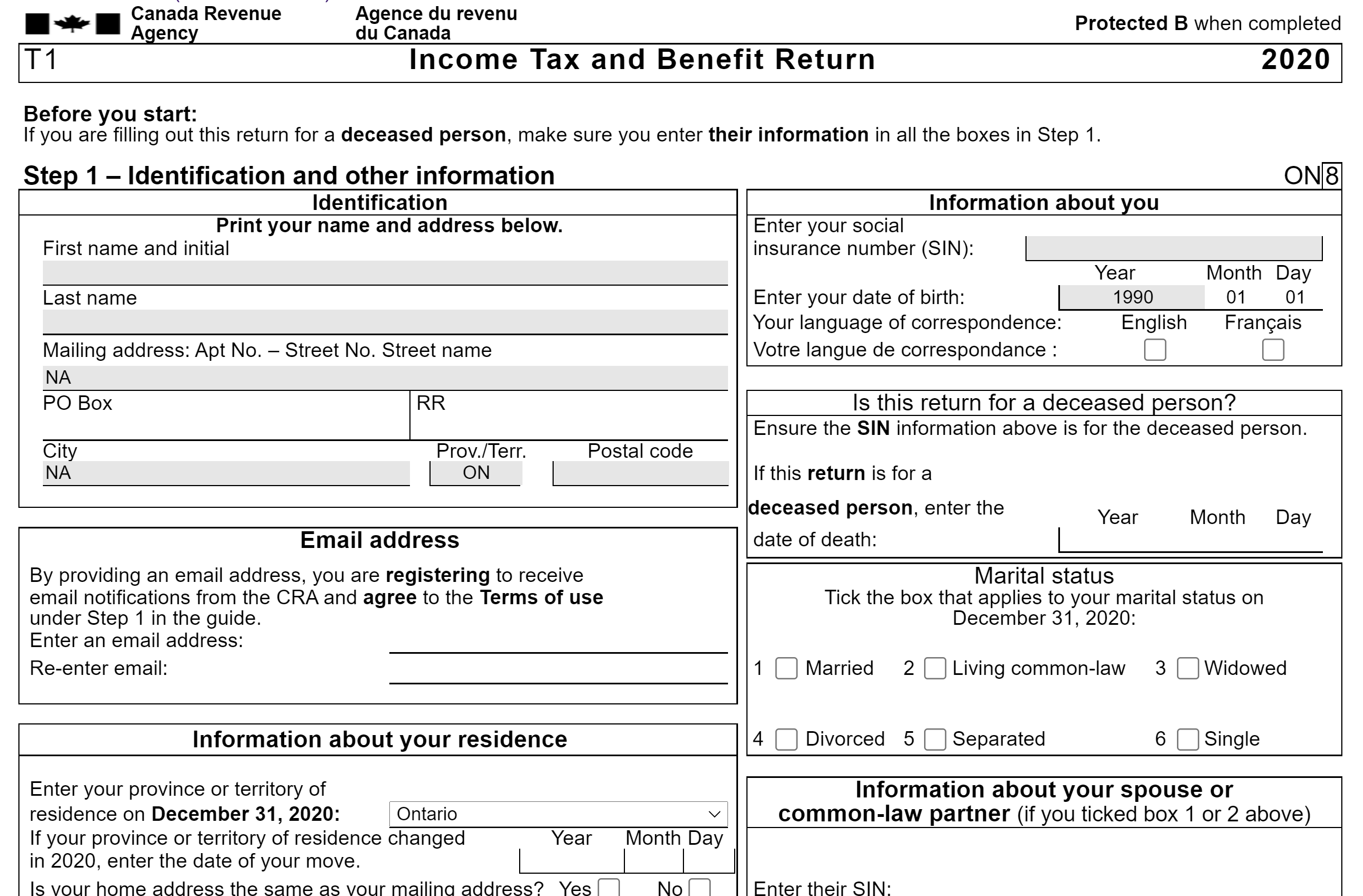

- Part A – Identification

You are to provide your information in this section, such as your name, address, Social Insurance Number (SIN), and marital status.

- Part B – Total income

Here, you will declare your income from every source possible such as; employment, self-employment, disability, foreign income, interests, dividends, rental income, and so on.

However, some income sources such as; gifts and inheritances, war disability pensions, the Canada Child Tax Benefit, and winnings from betting or gambling don’t have to be declared.

- Part C – Net income

These include your expenses like child care expenses, union dues, and subtracting from your total income.

- Part D – Taxable income

In this section, allowable deductions like capital gains are deducted from your net income.

- Part E – Refund or balance owing

Here, you will find out if you owe money or if you will get refunds. This is where total credits (including tax withheld) will be subtracted from net federal tax and provincial or territorial tax.

After deductions are made, and your total amount payable is calculated, you will receive a refund or balance, which may be zero or the amount you owe.

Generally, the T1 and balance owing for each tax year are due by the end of April of the following tax year. The T1 filing deadline is extended to the 15th of June if the taxpayer or their spouse or common-law partner earned income from a self-owned business at any time during the calendar year.

However, money owed to the CRA is due on the 30th of April in any case. The penalty for failing to pay by the due date will attract interest. You are not required to file a T1 return if the balance owing for that year is CA$0 or negative.

Provincial and Territorial Taxes

Except for Quebec, all the other provinces and territories in Canada agree with the federal government to collect personal income tax from their residents and distribute them back. If you reside in any province or territory besides Quebec, you submit one return, including pages for federal tax and pages specifically for your province or territory.

On those pages, the provincial or territorial tax will be calculated, along with tax credits, surtaxes, and tax reductions that are specific to your province or territory. Québec’s residents have to submit their federal income tax return to the CRA and their provincial return to Revenu Québec.

Filing and Mailing your T1 Form

You can choose to file your T1 form online or on paper. If you file it online, it is free and easy. All you have to do is use your CRA account and submit it electronically. If you file on paper, depending on your locations and whether or not you reside in Canada, you are to mail your T1 to any of the following addresses as it applies to you.

Residential Filing

If you reside in any of these provinces;

- Alberta

- British Columbia

- Manitoba

- Saskatchewan

- Northwest Territories

- Yukon

- Ontario; Hamilton, Kitchener, Waterloo, London, Thunder Bay, or Windsor

You should mail your T1 form to the following address:

Winnipeg Tax Centre

P.O Box 14001

Station Main

Winnipeg MB R3C 3M3

If you reside in one of these provinces;

- New Brunswick

- Newfoundland and Labrador

- Nunavut

- Nova Scotia

- Prince Edward Island

- Ontario: Barrie, Belleville, Kingston, Ottawa, Peterborough, St.Catherines, Sudbury, or Toronto

- Quebec: Montreal, Outaouais, or Sherbrooke

You are to mail your T1 to the following address;

Sudbury Tax Centre

1050 Notre Dame Avenue

Sudbury ON P3A 5C2

If you reside in other cities in Quebec besides Montreal, Outaouais, or Sherbrooke, you should mail your T1 to the address below;

Jonquière Tax center

2251 René-Lévesque Boulevard

Jonquière QC G7S 5J2

Non-Residential Filing

For non-resident Canadians, depending on the country you reside in, the mailing address varies. Due to international mail delays, you can send your T1 by fax to the CRA, but this is just a temporary development.

If you reside in any of the following countries or your representative resides in any of the following provinces or territories;

- United States of America

- United Kingdom

- Netherlands

- France

- Denmark

- Alberta

- British Columbia

- Manitoba

- Saskatchewan

- Northwest

- Yukon

- Ontario: Belleville, Hamilton, Kingston, Kitchener, Waterloo, London, Peterborough, Ottawa, St. Catherines, Thunder Bay or Windsor

You are to mail your T1 to this address.

Winnipeg Tax Centre

P.O Box 14001

Station Main

Winnipeg MB R3C 3M3

Canada

By Fax: 204-984-5164

If you reside in countries other than the ones stated above and your representative lives in any of the provinces below;

- New Brunswick

- Newfoundland and Labrador

- Nova Scotia

- Prince Edward Island

- Quebèc

- Ontario; Barrie, Sudbury, or Toronto

You can mail your T1 to

Sudbury Tax Centre

1050 Notre Dame Avenue

Sudbury ON P3A 5C2

Canada

By Fax: 1-855-276-1529 and 705-671-3994

How to Obtain the T1 Form

If you use tax software to file your taxes, you won’t need to get a T1 form as the software will automatically file it for you, depending on the information you provide. If you don’t use tax software, you are required to obtain the correct T1 form for each tax year you need to file from the CRA’s website.

You can access copies of T1 forms as far back as1985 and get these forms here. You need to select the correct form for the tax year you are filing for, as well as the province or territory you lived in at the end of the tax year as provincial and territorial rates apply.

The federal and provincial or territorial governments also have their section in the T1 form to calculate their respective taxes. If you want a copy of your previous T1 forms, you can get them if you have a CRA My Account.

You will see records of your T1 form for the current tax years and the previous ones for the 11 preceding tax years. If your T1 documents for years beyond that, you will contact the CRA (1-800-959-8281) and request a copy. Since tax forms are named for the tax year they apply to and not the current year, it is crucial to use each form.

You might need to keep a copy of your T1 if you need it as proof of your income or ask to provide it when applying for a mortgage or signature loan.

Making changes to your T1 General Form

Since nobody is perfect, mistakes are bound to happen. If you are yet to submit your T1 and observe an error, you will fill out a new one to amend the error. If you have sent your T1 after submission or mailing, you will need to notify the CRA as soon as possible.

If you file your form using software, you will fill out a new version of the form or enter new details into your tax software to correct the mistake.

You will be notified and advised on making adjustments or amendments by the CRA if you don’t notice the mistakes, but they notice it. This doesn’t apply to residents of Quebec.

If you reside in Quebec and need to amend your provincial return, see here. It is advisable to notify the CRA immediately you notice a mistake after you’ve sent out your taxes. You may not change the error if you do not notice the error until 90 days after you have gotten your report.

Don’t freight yet; the Voluntary Disclosure Program (VDP) gives a second chance to correct a tax return you previously filed or to file a return that you should have filed. Bear in mind that if you file a VDP, the CRA requires you to pay the taxes owing, plus interest in part or in full.

Conclusion

The T1 general form or Income Tax and Benefit Return is a personal income tax form used by Canadian taxpayers to report their income. It summarizes all the other forms, slips, and returns that Canadian taxpayers use to file their taxes.

Remember to request a copy of your T1 General as soon as your return is complete from the person who submitted your tax return. If you completed it on your own via software, you could always find your T1 General when you log in to the software. You can always contact the agency or person who completed your return to request a copy if you have issues finding your return.